Nathan Austin

Nathan Austin is your go-to real estate expert, bringing an exceptional background in Structural & Forensic Engineering to Eleete. His extensive knowledge of buildings and land, combined with a deep understanding of local construction history, gives him a unique edge. Nathan’s expertise means he knows exactly how homes are built, how they can fail, and how to fix them properly, ensuring you get the best possible property.

Why Choose Nathan Austin?

Expert Insight:

With a comprehensive understanding of home construction, Nathan can identify potential issues that others might miss. This means you can buy with confidence, knowing that your investment is sound and secure.

Local Knowledge:

Having grown up in Oregon and lived in the Portland Metro area for the past 24 years, Nathan has an intimate knowledge of the community. He understands the local market, ensuring you find the perfect home in the ideal neighborhood.

Personal Integrity:

Nathan is renowned for his hard work, honesty, and trustworthiness. His integrity shines through in every transaction, and his friendly demeanor makes the buying process enjoyable and stress-free. Plus, he has a great sense of humor, making him a pleasure to work with.

Client-Centered Approach:

Nathan cares deeply about his clients’ wants and desires. He listens intently to understand their unique needs and works tirelessly to meet them. His commitment to client satisfaction is evident in his personalized service and attention to detail.

For Buyers:

Nathan is dedicated to finding you a quality home that meets your needs. He listens carefully to your wants and provides honest, expert opinions. During inspections, his background in engineering allows him to spot potential issues and negotiate necessary repairs effectively, ensuring you secure a high-quality home.

For Sellers:

Nathan learned how to present homes in architecture school and employs proven marketing strategies and expert negotiation skills to maximize your home’s value. His approach ensures you retain more proceeds from the sale and achieve quicker results, reducing stress and uncertainty throughout the process. With Nathan, you’re in expert hands.

For Investors & Flippers:

Nathan’s analytical approach to market evaluation helps identify properties with high potential. His structural engineering background allows him to provide practical and affordable solutions, ensuring you have a clear understanding of a project’s profitability before making an offer. His comprehensive market analyses give you confidence in your investment decisions.

Credentials:

•Bachelor’s Degree in Architectural Engineering

•Previous career in Structural & Forensic Engineering

•Real Estate Negotiation Expert

•Experience in Lot Splitting & Lot Segregations

•Experience in Construction & Remodeling

Outside Real Estate:

Nathan is an avid tennis player, golfer, and skier. A devoted father, he enjoys spending time with his son & quirky Corgi. He loves traveling, camping, and embracing the great outdoors.

Choosing Nathan Austin means choosing unparalleled expertise, integrity, and a personal touch. Let him guide you to your dream home or investment with confidence and ease!

Sold Portfolio

- 1/25 25

sold

$570,000

2 Beds1.1 Baths2,432 SqFt6301 SW 35th AVE, Portland, OR 97221

Single Family Home

Listed by ELEETE Real Estate

- 1/35 35

sold

$524,000

3 Beds1 Bath1,887 SqFt7420 SE GRANT ST, Portland, OR 97215

Single Family Home

Listed by ELEETE Real Estate

- 1/27 27

sold

$515,000

2 Beds2 Baths1,053 SqFt38348 RICHARDSON GAP RD, Scio, OR 97374

Single Family Home

Listed by Xiao Tang

- 1/48 48

sold

$940,000

3 Beds2.1 Baths2,088 SqFt4340 SE JOHNSON CREEK BLVD, Milwaukie, OR 97222

Single Family Home

Listed by ELEETE Real Estate

- 1/40 40

sold

$760,000

2,956 SqFt20409 SW MIDLINE ST, Beaverton, OR 97003

Multi-Family

Listed by ELEETE Real Estate

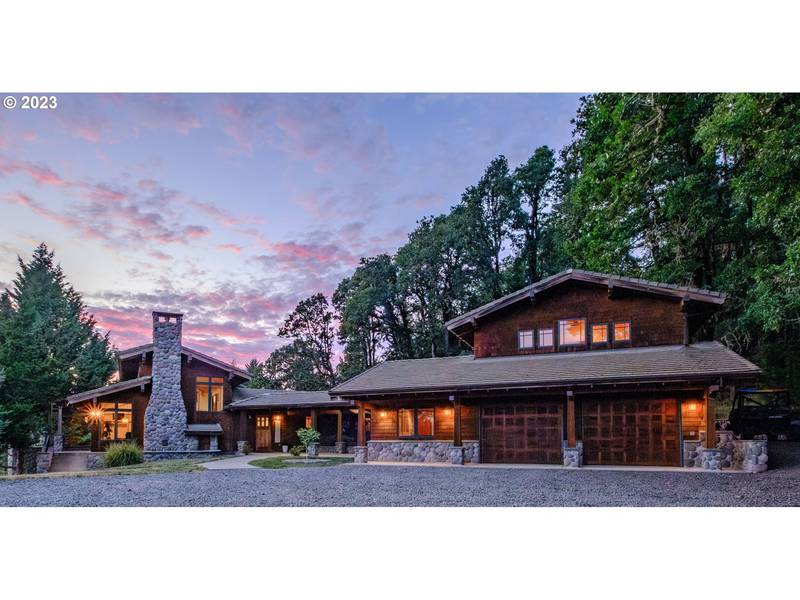

- 1/8 8

sold

$1,000,000

3 Beds3 Baths3,811 SqFt22655 SW HOUSER RD, Sheridan, OR 97378

Single Family Home

Listed by HomeSmart Realty Group

Opinion: As development costs skyrocket, a call to publicly finance Portland's BDS

The City of Portland has announced an increase in building permit fees by 10% in July – greater than current inflation rates - and Multnomah County is considering a similar increase. This continuous march toward ever-rising public costs in new housing construction perpetuates a bloated and broken system with no relief in sight. Before the Portland City Council’s approval of this recent increase, the director of the Bureau of Development Services voiced concern about the unsustainable nature of BDS funding, and in addition to a fee increase asked for an allotment from the city general fund to stabilize the bureau and forestall yet another cycle of firing and hiring based on variable market conditions. The latter request was denied. Consequently, we face a negative ripple effect on both homeowners and home builders, exacerbating the home affordability crisis. As a realtor, retired from structural engineering, I’ve seen people struggle with the effects of a real estate market constrained by increasing costs and a system that creates a disincentive for new home building. I believe we must address the inherent flaws in this self-perpetuating system and consider alternatives, including whether there is a way to publicly finance city or county development services instead. We’ve underbuilt since 2008, both locally and nationally, pushing prices up and making it a challenge for builders to turn a profit. With interest rates at a 10-year high, builders’ holding costs have risen accordingly, along with all the other costs of new construction: land pricing (location-dependent), soft costs (architectural and engineering drawings), labor pricing, material costs, selling fees, and permit fees and SDC charges. Correspondingly, the rising cost of building new homes affects the cost of existing homes, too. Even homeowners with a low interest rate face an unpleasant surprise when they go to purchase their next home and find prices that have escalated thanks to the increasing fees and charges applied in the market overall. Insurance rates & labor markets are also affected by inflated home values driven by the increased cost to build more housing. Using general fund or other non-fee resources to stabilize permitting functions and create greater efficiencies will incent existing builders, lower the cost of entry for entrepreneurs who want to build new housing, and spur new construction even with the current interest rates. Despite the pleas of multiple development groups and business advocates, the increased fees are moving ahead. But let’s keep the conversation going to pause fee increases and explore alternate funding for permitting for the benefit of our housing market and local economy.

Read more

December Newsletter- 2024 Real Estate Forecast!

I’m hoping everyone is having a wonderful Holidays and can spend it with friends and family!! I thought I’d close off this year with some thoughts on what I anticipate for 2024. We recently got a nice gift from the Fed when they signaled they would end their program of rate hikes, and would start to look for signs from the economy that would prompt them to cut rates. This signaled the mortgage lenders they could tighten up rates, and due to that we saw a 6.375% rate a week or so back, compared to a high of 8% just a couple months ago. I expect there to be three different periods over the next year or so, during which things are steady, then there’s increased competition and an increase in home values, and then lastly another leveling off and a slightly more open market. We are currently in the first period, where we’re seeing slight gains in home price appreciation, driven by low availability despite an increase in mortgage rates. We’re still dealing with an affordability issue, or sticker shock for buyers that are accustomed to the former price paradigm. Buyers from out of state with a different comparable mindset do not face this issue as they’re coming from a more expensive market. However, if you do have the ability to purchase a home, it’s going to be a healthy home buying market as factors such as inspections, negotiations in the price, negotiations around fixing issues, rate buy downs and closing credits are in play. From December 2022-December 2023 appreciation for the Portland metro is around 1%. This may vary from neighborhood to neighborhood, but generally this is the trend. For buyers who are less price sensitive, then I would consider making a move in this first period. As the second period is going to see increased competition & prices. Additionally, if you’re looking to sell and also buy a property, then this will be the healthiest time to do so before the changing market in the second period. The second period will be when we start to see mortgage rates come down. This will bring more buyers into the market. Even as this occurs, we will still be constrained on inventory due to underbuilding of new construction, and large amounts of existing homeowners with 3-4% loan mortgage rates continuing to stay out of the market. I’d expect a sweet spot at the beginning of this period for those who move quickly, and time their mortgage rate for the home they want to buy. For those of you being challenged by affordability, remember back to the technique of identifying the home price range, and then back calculating your needed mortgage rate. However, once we see more buyers in the market prompting more competition amongst buyers, I expect to see offers above asking price, multiple offers, offers written “as-is”, waiving inspections, and an associated quick rise in appreciation. I don’t think prices will rise as quickly as they did through 2020-2022 as affordability will likely constrain appreciation, as rising price push some buyers out of the market and reduce competition until rates come down in their price range, and then cycle repeats. Unless you’re dealing with the affordability issue and you need rates to come down to afford the home you want, I’d try to avoid this period unless you’re prepared to face competition. If you’re exiting the market or have a home that might have some issues, this would be the time to put it on the market. Just be prepared if you’re buying again as it won’t be exactly smooth sailing and may require some fortitude and patience. The third period is where we see mortgage rates declining sufficiently and/or some combination of appreciation and lower mortgage rates to open part of the existing housing stock of folks that are holding 3-4% loans. This should reduce inventory constraints. During this period, I’d expect a typical amount of appreciation as we return to a healthy market which features modest annual appreciation. It’s important to note that our region will remain underbuilt, we are roughly 140,000 homes short in Oregon. I don’t see this getting solved in the next five years. I’ve previously talked about the lack of building professionals, and trades people. Signs that the market has returned to a healthy condition are buyers demanding inspections, negotiations returning, and only the hot or underpriced properties receive multiple or “as-is” offers. The soonest I’d expect to see this period is the end of 2024, but it will more than likely take a few years to get here. Of course, macro factors can derail this forecast, including increased global conflict, a natural disaster, escalating oil prices or domestic political events that rock the boat. However, The United States economy is forecast to grow mid 2 percent for the next three years and growth surprised most to the upside in 2024. Oregon remains an attractive place to live and work and should continue to do so. Feel free to reach out, I’m happy to help you or anyone that you may refer. Have a Happy New year!

Read more

November Newsletter- The NAR Lawsuit

It’s the end of November, we’ve had another month of some beautiful fall weather. I hope everyone had a good Thanksgiving! I’m a little slow getting this monthly news email out with the Holiday. A few things of note before I dive into this month’s newsletter topic. Kids are back into school for PPS! If you’ve been a parent with a kid in Portland Public Schools, it’s literally been “No School” November. Another big thing of news is mortgage Interest rates dropped by a half a percent! We’re finally starting to see mortgage rates come down, and I expect this trend to continue throughout next year. Oil & gas prices continue to drop, credit card balances are at an all-time high and I expect the student loan payments to continue to diminish consumer spending. We have some good inflationary numbers today, so what the Fed has been doing is working. The only outlier here is Christmas which might prop up spending for another month, but I think in Q1 and Q2 we’re finally going to turn that corner & we’ll see some more reasonable rates later in the year. The other thing of note in the real estate world, is the National Association of Realtors lost its lawsuit in Missouri, and that’s what I’d like to get into this month. I’m sure many of you have at least read a bit about the media’s chicken little’s “the sky is falling” version of all the different scenarios, and how this is going to totally disrupt the system. A gentle reminder the media gets paid by advertisers by the amount of viewership or clicks, most of these stories are written around a few people’s opinion and conjecture. For those who missed the news cycle, I’ll briefly summarize, NAR and a few other real estate entities got sued by the plaintiff home sellers in a class action lawsuit in the state of Missouri. Basically, what the lawsuit was about was that the plaintiffs accused NAR and the RMLS of colluding to keep the commission rates artificially high and requiring the sellers to pay the buyer’s agent commission fee. I’ll do my best to be unbiased and as factual as I can, but you might see some bias leak out occasionally. There’s always been varying ways to sell a home. A home can be sold on RMLS through a professional realtor, it can be sold through a discount brokerage on RMLS, and it can be sold “for sale by owner”. Some of these class action lawsuits originate with law firms and then they solicit the plaintiffs. Through a bit of quick research, lawyers in these class action lawsuits get about 35-45% of the damages awarded. I’m sure they found some bad actors to prove their case, and from my understanding, it didn’t help that the entire jury was non-homeowners. The suit was brought accusing NAR and other large brokerage firms of colluding to keep commission rates high, and not giving the seller’s an option of not paying the buyer’s agent. I’m clearly not a lawyer, so I’m sure I’m missing some nuances of the case, but wasn’t the original choice made by the sellers to not list their home “for sale by owner”, they chose the benefits of the RMLS to get quality representation in selling their home and reach a greater audience of potential buyers? The current system has been successfully working for over 100 years with commission rates steadily decreasing over time, and per the individual agent. Regarding the plaintiffs, this seems like a “get your cake and eat it too scenario”. Everyone who has ever bought a home through the RMLS has benefitted from this system, and it continues to work for buyer representation. My fear is it’s going to disproportionately affect first time home buyers and people with less money. Most of these folks are tight on money to get into a home and may forgo using a buyer’s agent to their detriment. Are there plenty of bad & lazy realtors out there who aren’t worth their salt? Absolutely! I’ve heard plenty of anecdotes about how bad their previous realtor was, and how they did absolutely nothing and still got paid. The buyers used Zillow, Redfin or Realtor.com to find their house, and then also did all the negotiations. Should the realtor have got paid to the extent they did? No. Part of the problem is the entry requirements to becoming a realtor are relatively low, and you get people in the business for the wrong reasons. Part of the problem is Zillow, Redfin, and Realtor.com but not the way you’d expect, that’s for a later newsletter. There’s a lot of part timers in this industry, and there’s a lot of people that don’t put in the work to be good. Do I think people should be asking more of their realtors, and how they’ve done for their clients? Absolutely. The biggest thing in real estate is understanding the market conditions and knowing how to play the hand for each different situation. There’s a lot of things I do personally to keep up to date and know how to put my clients in the best position possible. I spend a lot of my time reading economics reports, touring houses to know inventory & for pricing, keeping track of what things sold for, going to industry education classes, figuring out market dynamics, and researching different areas of real estate. Can someone represent themselves? Yes, but it’s hard to do it well unless your emersed in the market. For my buyer clients this year, on average I negotiated a total of 3.4% of the sales price in seller financed closing credits, rate buy downs, structural fixes, and minor home repairs. In home equity I got them on average 4.4% of instant equity in their purchased home (where the home appraised more for market value). Between these two factors my clients netted 7.8% of the total sale price, which is over 3x what my brokerage got paid & was paid by the home seller. These numbers don’t include the time & money I saved my clients in telling them to walk away from homes with structural or quality issues before an offer was written and an inspection done. These numbers also don’t include the quality of the houses and the happiness of my clients. So, we’ll see what happens with the industry the next few years. I’d expect to see your realtor have you sign an agreement on compensation at the start of the process from here on out. In the comings months I’d like to investigate Zillow, Redfin, and Realtor.com and the effects on the industry. Have a Happy Holidays just in case I’m delayed in writing because of them!

Read more

What Is Your Home Really Worth?

With a Detailed Price Report, you can be confident that you know the value.

- 1/23 23

Active

Active$169,900

1 Bath347 SqFt1631 NW EVERETT ST #407, Portland, OR 97209

Condo

Listed by ELEETE Real Estate

- 1/10 10

Active

Active$399,000

1.17 Acres7324 NW PENRIDGE RD, Portland, OR 97229

Vacant Land

Listed by ELEETE Real Estate

- 1/24 24

Open Sat 1PM-3PM

Open Sat 1PM-3PM$699,999

4 Beds2.1 Baths2,064 SqFt15079 NW COSMOS ST, Portland, OR 97229

Single Family Home

Listed by ELEETE Real Estate

- 1/47 47

Open Sat 11AM-3PM

Open Sat 11AM-3PM$999,999

4 Beds3.1 Baths3,384 SqFt9602 NW THOMPSON RD, Portland, OR 97229

Single Family Home

Listed by ELEETE Real Estate