Opinion: As development costs skyrocket, a call to publicly finance Portland's BDS

The City of Portland has announced an increase in building permit fees by 10% in July – greater than current inflation rates - and Multnomah County is considering a similar increase. This continuous march toward ever-rising public costs in new housing construction perpetuates a bloated and broken system with no relief in sight.

Before the Portland City Council’s approval of this recent increase, the director of the Bureau of Development Services voiced concern about the unsustainable nature of BDS funding, and in addition to a fee increase asked for an allotment from the city general fund to stabilize the bureau and forestall yet another cycle of firing and hiring based on variable market conditions. The latter request was denied. Consequently, we face a negative ripple effect on both homeowners and home builders, exacerbating the home affordability crisis.

As a realtor, retired from structural engineering, I’ve seen people struggle with the effects of a real estate market constrained by increasing costs and a system that creates a disincentive for new home building. I believe we must address the inherent flaws in this self-perpetuating system and consider alternatives, including whether there is a way to publicly finance city or county development services instead.

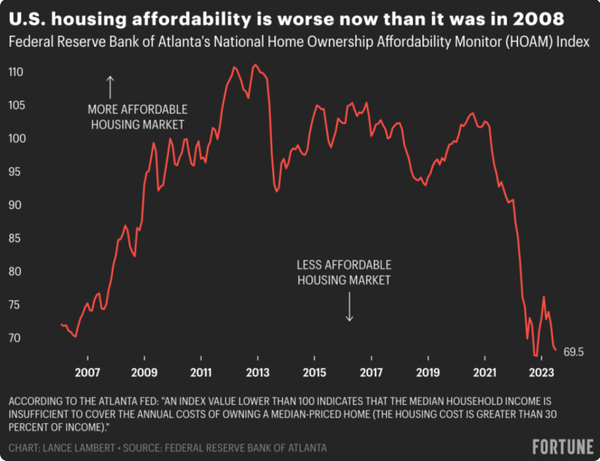

We’ve underbuilt since 2008, both locally and nationally, pushing prices up and making it a challenge for builders to turn a profit. With interest rates at a 10-year high, builders’ holding costs have risen accordingly, along with all the other costs of new construction: land pricing (location-dependent), soft costs (architectural and engineering drawings), labor pricing, material costs, selling fees, and permit fees and SDC charges.

Correspondingly, the rising cost of building new homes affects the cost of existing homes, too. Even homeowners with a low interest rate face an unpleasant surprise when they go to purchase their next home and find prices that have escalated thanks to the increasing fees and charges applied in the market overall. Insurance rates & labor markets are also affected by inflated home values driven by the increased cost to build more housing.

Using general fund or other non-fee resources to stabilize permitting functions and create greater efficiencies will incent existing builders, lower the cost of entry for entrepreneurs who want to build new housing, and spur new construction even with the current interest rates.

Despite the pleas of multiple development groups and business advocates, the increased fees are moving ahead. But let’s keep the conversation going to pause fee increases and explore alternate funding for permitting for the benefit of our housing market and local economy.

Recent Posts

GET MORE INFORMATION