August Newsletter-What's causing the affordability issues

August newsletter. It’s almost back to school for the kids. Hopefully everyone has had a wonderful summer. I’ve been having fun helping some folks find quality homes.

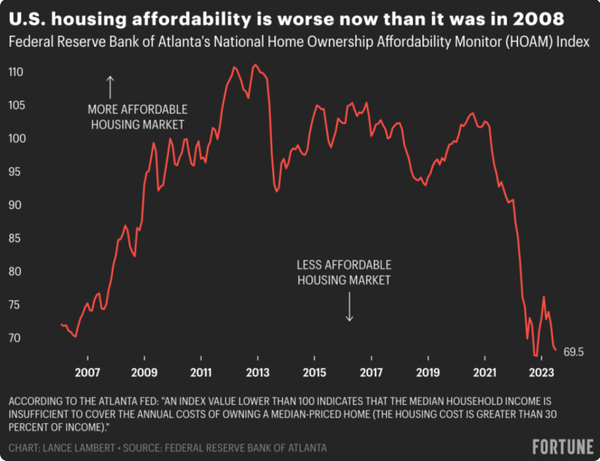

Last month I talked about how to back solve the affordability problem that is going on in the market, and picking the moment to move when the high interest rates eventually drop before that 5.5% point. This month I did a deep dive into why we’re in an affordability crisis, and how we got here. It gives us a good idea of what the obstacles we face for affordable housing, and how this impacts house pricing. It’s a kaleidoscope of problems.

We’ll start back in 2008, aka the Great Recession, where bankers played loose with the mortgages, and the subsequent fall out from that. The government propped up the banks that were at the heart of the problem but failed to support the building professionals that worked in the industry that designed, created, and built it. It was a bleak time, we lost about half of the professionals & small-time builders. Most of these folks never came back to the industry, and to be honest why should they. Once bitten, twice shy. This dramatically reduced our capacity to build as a nation & a region. We’ve been slowly building back up businesses, but it’s not where it should be.

At the local level the big issue from an affordability standpoint is how the building departments are funded. The building departments tend to be 100% funded by permit fees. When you add up all the fees for Washington County or the City of Portland for a new house it’s about $50,000-$70,000. Jurisdictions like to have the developers fund infrastructure building, for example curbs, sidewalks, and street improvements. This adds to the cost of the total project, and the total sale price of a project. This July, the City of Portland BDS raised it permit fees by 5-10%, and Washington County raised it permit fees by 50%. If we as a community want to bring down the cost of building, these programs need to be entirely tax funded, and the jurisdictions needs to be building the public infrastructure. The cost of new construction directly plays into the affordability of housing, when it costs more to build something new, it makes the existing homes on the market worth more. If we can take these costs out of the equation, we can reduce how much developers need to sell a house to make a profit which will in turn bring the markets affordability down.

On a federal level President Trump, put into place a bunch of tariffs in 2018 with the good majority of these effecting the building industry either through raw materials, parts, machinery, and other supplies. The tariffs are as follows, Wood 20%, Steel 25%, Aluminum 10%, parts made of steel 25%, machinery 25%, and the list goes on. The impact of these tariffs directly raises the cost of new construction, hence increasing the value of all the existing buildings, and pushing affordability up. Below is a graph of the increase of the value of homes since 2016. Some of this increase was affected by supply chain shortages from the Covid pandemic but adding a 20-25% markup to the materials of a house doesn’t help. President Biden has largely left these tariffs in place, except for reducing the tariff on wood by 10%. It’s generally regarded that these tariffs have hurt our economy, and I would argue that it’s had a direct impact on the affordability of homes. Is China or the other foreign entities paying the tariff, the answer is no, we as the consumer pay for it. The 20-25% markup gets paid to the federal government, so as much as anyone in the federal government talks about solving the housing affordability issue, the biggest thing they could do would be to remove these tariffs.

There’s some argument that the Urban growth boundaries has contributed to supply problems. I would say yes, and no. For the large tract builders, it’s limited how much they can build. After spending 23 years in the building industry, I’m not impressed with the quality of homes from DR Hortons, Lennar or Toll Brothers to name a few. Smaller builders the urban growth boundary has less of an impact on, as these folks are building on individual lots that are already established within the City. You could argue that the smaller builders are better for our local economy as well. As more of the money is being kept in the community by the smaller builders than those national builders that have headquarters and management located elsewhere.

Another impact that’s driven up prices the impact of large investor groups buying up the single-family home and turning them into rentals to provide a return to the investors. This shrinks the available housing stock and pushes up prices. The whole law of supply and demand and how it drives the price of goods. There are many benefits to owning rental property for acquiring wealth, I think smaller investors are great, and healthy for the industry. Typically, most smaller investors are local and the money stays in the community. Generally, these large investment groups are in other parts of the country, and the money is leaving the community to be spent elsewhere.

I’ll briefly touch on the Building Code, and I’ll preface this section by saying I think the building code is necessary from a life safety perspective and is good for the health and safety of our communities. However, the code continues to get more complex over the last 20 years. I agree with increasing insulation in buildings & R values in windows. However, I think there needs to be work done to simplify the code to reduce the complexity of it from the professional design standpoint, and from the code enforcement requirements. The American Society of Civil Engineers estimates that the number of engineers nationwide is decreasing each year. Moody’s estimates that the industry will need to create an additional 883,600 jobs by 2030. There’s a bit of a disconnect in the numbers if we continue this trajectory, we’re going to have a labor shortage that’s going to weigh on affordability.

The last big contributor going on with affordability is the high interest rates, last week we hit a 22 year high for mortgage rates. This is well reported in the media, so I don’t feel like I need go further into it, but it’s huge problem for the building industry. Maybe not for the big builders who bake this into the home price, but for everybody else in the industry it’s a problem. My concern with this continued pressure is that the Fed is going to put a lot of the smaller businesses out of business, like what happened in 2008. I understand the commercial side of the business is hurting worse than the residential side of the industry. My concern is if the Fed bludgeons the industry the industry with high rates, we lose even more professionals to something else in a downturn, and instead of being the little engine that could, were the little engine that can’t.

Governor Kotek’s team has pitched opening wetlands for building areas and getting rid of Portland’s tree removal fee ordinance. I don’t think either of these are decent solutions, and are rather short sighted. Building on wetlands opens up to a litany of long-term problems in a building and reduces areas of ever shrinking habit for some of four legged and winged friends. The tree removal program isn’t perfect, but it does encourage replanting of trees for the tree that are cut. This helps the beauty of our city as well as reduce heat in the summer.

If I missed some other contributing factors, please let me know what you think I missed. The more I’m informed the better I’ll be able to help you all. Without the Fed crushing the building industry I don’t see a way for the affordability to get better without improving one or all these other factors. Hopefully, we’ll see some changes at the Local, State, and Federal levels that can bring the affordability problem into check. I’ll keep you up to date what shifts I’m seeing as the market adjusts. The interest rates dropping will have the biggest & fastest impact on affordability. All these other issues will help affordability if they can be resolved, but there will be a lag in time on how it affects the pricing of the market.

Till next month! Have a great Labor Day weekend and stay safe. I’ll be hosting a US Open viewing party September 10th to watch the Men’s Final at the Eleete office downstairs lounge. There’s like eight or so screens, anyone is welcome to come. I’ll do some sort of food and drink.

Recent Posts

GET MORE INFORMATION