Hidden Down Payment: How to Strategically Leverage Your 401k for Home Purchasing in a Hot Market

Are you a prospective homebuyer eager to step into the realm of real estate? Perhaps you're feeling the pressure of saving up for that all-important down payment, or are worried that you have to sell your current before making an offer on the next one due to the competitive nature of the current market stigma against making “contingent” (upon sale) offers. If you find yourself in this situation, fear not! There may be a hidden asset right within your grasp – your 401k. Many people view their 401k as a sacred nest egg, one to be left untouched until their golden years. However, the rules surrounding 401k accounts allow for certain exceptions to be made to tax liability and early withdrawal penalties. Utilizing a 401k loan for a down payment for the purpose of securing a primary residence is one such exception! This strategy can be an effective way to bridge the financial gap between your aspirations and your current savings. But before we dive into the details, let's explore what a 401k loan entails. A 401k loan, as the name suggests, allows you to borrow money from your own retirement savings. The amount you can borrow is typically limited to a percentage of your account balance (typically 50%), whether you’re fully vested, or a specific dollar amount. The loan must be repaid within a specified timeframe, and with interest. The interest you pay on the loan goes back into your own account, making it a relatively low-cost borrowing option compared to other forms of loans. When YOU play the banker, you WIN! Right now, one of the most significant advantages of leveraging a 401k loan for a down payment is the potential to make non-contingent offers (where you must successfully sell your current home, in order to have proceeds available for the purchase) in a competitive seller's market. In our market, where multiple buyers are vying for limited inventory, sellers often prefer non-contingent offers as they are more likely to close quickly and smoothly. By utilizing a 401k loan, if you’ve got enough to work with, you can bridge the gap between representing your offer as "contingent upon securing financing" and making it "non-contingent," thereby increasing your chances of having your offer accepted. Then, once you’ve successfully sold your current home, you can easily pay yourself back the proceeds you borrowed from yourself. Nice move! Additionally, increasing your down payment allows you to pay less Mortgage Insurance, and in some cases, can improve your interest rate, thereby offsetting some of the cost associated with borrowing it. Those funds can also be used to cover closing costs, or pay points toward lowering the rate on your first mortgage as well. Tight on your debt-to-income ratio? (Measured as the amount of monthly income you make, vs monthly credit debt obligations + proposed total mortgage payment.) There are limits that lenders have in place for these (generally between 45 and 50%) and in the current climate, affordability is something that can be a limiting factor for how much home you can purchase. This is especially frustrating for married people who have two incomes, or partners that help with the rent/payment, but won’t be on the mortgage together with the buyer due to either credit or income issues. A 401k can help with this as well! The reason for this, is that underwriters do not include the resulting debt from the 401k loan against your DTI calculation. While this may seem counterintuitive, its an advantage that is often overlooked when people “push button, get mortgage.” Yet another reason to avoid online lenders, as price vs. advice makes a big difference in the mortgage world. There are LOTS of creative ways you can work with these available funds, and being in contact with a licensed Mortgage Advisor will help you sort out and compare different scenarios, while weighing the tradeoffs. It's important to approach this strategy with caution. While a 401k loan can provide a valuable opportunity to secure a down payment, it does come with certain risks and limitations. For instance, if you are a first time homebuyer, and leave your job before repaying the loan, you may be required to pay it back in full immediately or face paying taxes on the amount as income. Additionally, if you fail to repay the loan within the specified timeframe, it could be treated as an early withdrawal, resulting in a penalty somewhere in the neighborhood of 10%. Therefore, it's crucial to thoroughly understand the terms and conditions of your 401k loan and consider the potential long-term impact on your retirement savings. Here are a few key considerations to keep in mind when contemplating a 401k loan for a down payment: Key Considerations when Utilizing a 401k Loan for a Down Payment: Loan Terms and Repayment: Familiarize yourself with the specific rules and regulations regarding 401k loans within your retirement plan. Understand the maximum loan amount, interest rate, repayment period, and any associated fees. Evaluate your ability to repay the loan within the specified timeframe, considering your current financial situation and budget. Impact on Retirement Savings: Consider the long-term implications of borrowing from your 401k. While a 401k loan can provide immediate funds for a down payment, it reduces the amount of money invested in your retirement account, potentially impacting your future savings and growth. Evaluate whether the potential benefits outweigh the potential drawbacks and consult with a financial advisor if needed. Job Stability: Assess your job stability and the potential impact on the 401k loan. If you leave your job before repaying the loan, you may be required to pay it back in full immediately or face penalties. Evaluate the security of your employment and factor in any potential career changes or transitions in the near future. Tax Implications: Understand the tax implications associated with a 401k loan. While the loan itself is not considered taxable income, failure to repay the loan within the specified timeframe could result in the loan being treated as an early withdrawal, subjecting it to income taxes and potential penalties. Consult with a tax professional to fully understand the tax consequences of utilizing a 401k loan for a down payment. In conclusion, leveraging your 401k through a loan for a down payment can be a valuable strategy for prospective homebuyers looking to enter the real estate market. It can bridge the financial gap, accelerate your path to homeownership, help you afford more home, and even give you an advantage in a competitive seller's market. If you’re interested in gaming it out to see what the numbers might look like in your specific situation, Bryce Elder @ Sunrise Mortgage Group would be happy to consult with you on this topic using some of the most advanced tools available in the marketplace.

Read More

Steps to buying a home!

(Note- I've built a buyer's pamphlet since I wrote this, that's much more in depth, feel to reach out & I'll send you a pdf) What you can expect in the process of buying a home! 1. The first step is getting preapproved. Why is it important to get preapproved? First it lets us as a Realtor know the range that we can search for in property, and second any offer we submit on your behalf for a home needs to have a preapproval letter attached. 2. We meet to discuss your goals, market trends, neighborhoods, get you setup on a search, and start home shopping! 3. Once we find a great home that you like, we make an offer! I’ll write that up for you with the terms. I’ll advice you along the way. We negotiate the terms and offer acceptance. 4. Typically, we’ll want to order a home inspection & evaluate any repair. Negotiate whether the repair will be a buyer credit or price reduction or whether that work is to be done before closing day! 5. After the home inspection, the home appraisal is ordered and the paperwork for the loan approval gets done. 6. It’s closing day! You sign the papers and get the keys to your new place!

Read More

What the Market is doing in April.

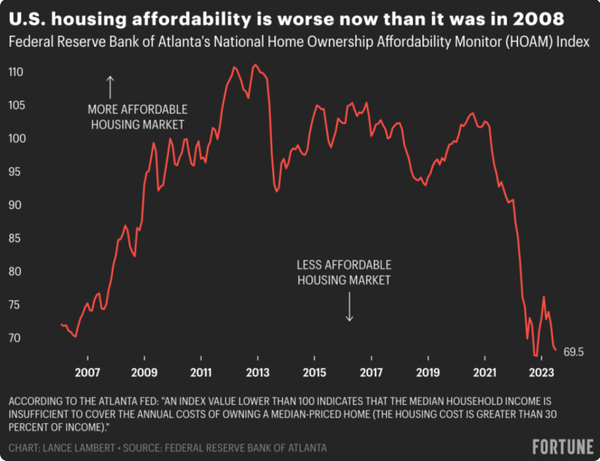

Our expectations regarding the market incentives created by low interest rates came into focus in the first 13 weeks of the year, with listings (supply) off sharply from the year prior. We ended the quarter with the gap between this year and last growing wider, a signal that appears to indicate continued low transaction velocity heading into 2Q. This lack of supply appears to have stabilized pricing, and along with seasonal adjustments that look familiar, both median price and percent paid to asking bottomed in January and improved in February and March. Properties below the median now sell, on average, for 100.3% of asking price. Days on market also declined month-over-month for the entirety of the first quarter, now down 18% from the high in January. On the all-important subject of interest rates, inflation continues its steady (but slow) decline, and the last several months give reason to believe we are largely past rate increases. Below we see the annualized rate of inflation, average 30-year mortgage rate, and the real world rate taken by subtracting the yield on the 30-year mortgage from inflation. For nineteen months real world rates remained negative, that is the return on a 30-year mortgage was less than the rate of annualized inflation. As inflation fell and rates rose, real world rates turned positive in December and continue to improve. This is a welcome indication that interest rates are stabilizing and will fall along with inflation as we progress through the year. Bottom line: - The influence of low interest rates on sellers continues to impact supply - Buyer demand remains strong – absorption is in the 95-100% range and DoM is falling - Properties now sell on average for 100% of asking price - Without additional shocks to the system (i.e. bank failures, etc.), interest rates appear to have stabilized and there is a solid basis for expecting them to fall in the coming months - Housing is not going to become more affordable in the near future, as prices are reacting quickly to lack of supply and abating rates Stable pricing and low velocity – we have an interesting year ahead.

Read More

The real economic cost of waiting to buy

With interest rates rising I was curious what the math was for people renting and waiting for interest to drop while continuing to rent, rather than buying a house now. I called up to a smart mortgage lender to get his take on it, and he happily ran two different scenarios with a few different options at 5% & 20% down. I'm sharing what he ran for me to satisfy my curiosity, as it showed that if you're interested in buying it's really not worth waiting. Confirmation of the math of real lived experience, was talking to some of the older generation who lived through 18% interest rates, their philosophy having weathered the storm was buy now, refinance later. Nathan Austin #201244900 503.530.9446 Nathan.Austin@EleeteRE.com Eleete Real Estate 5% Down Scenario Link to the original source: https://mcedge.tv/navuq4 20% Down Scenario Link to the original source: https://mcedge.tv/c1tqq8

Read More

Recent Posts