What the Market is doing in April.

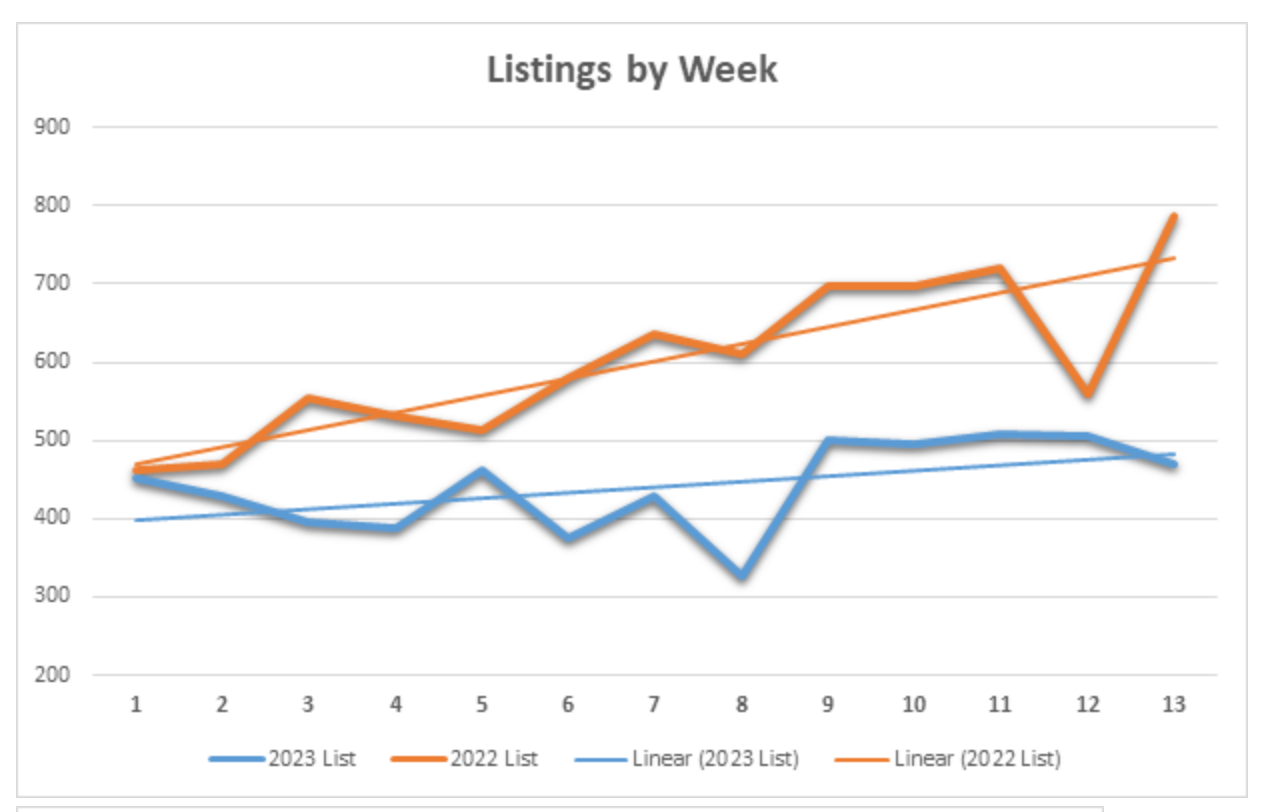

Our expectations regarding the market incentives created by low interest rates came into focus in the first 13 weeks of the year, with listings (supply) off sharply from the year prior. We ended the quarter with the gap between this year and last growing wider, a signal that appears to indicate continued low transaction velocity heading into 2Q.

This lack of supply appears to have stabilized pricing, and along with seasonal adjustments that look familiar, both median price and percent paid to asking bottomed in January and improved in February and March. Properties below the median now sell, on average, for 100.3% of asking price. Days on market also declined month-over-month for the entirety of the first quarter, now down 18% from the high in January.

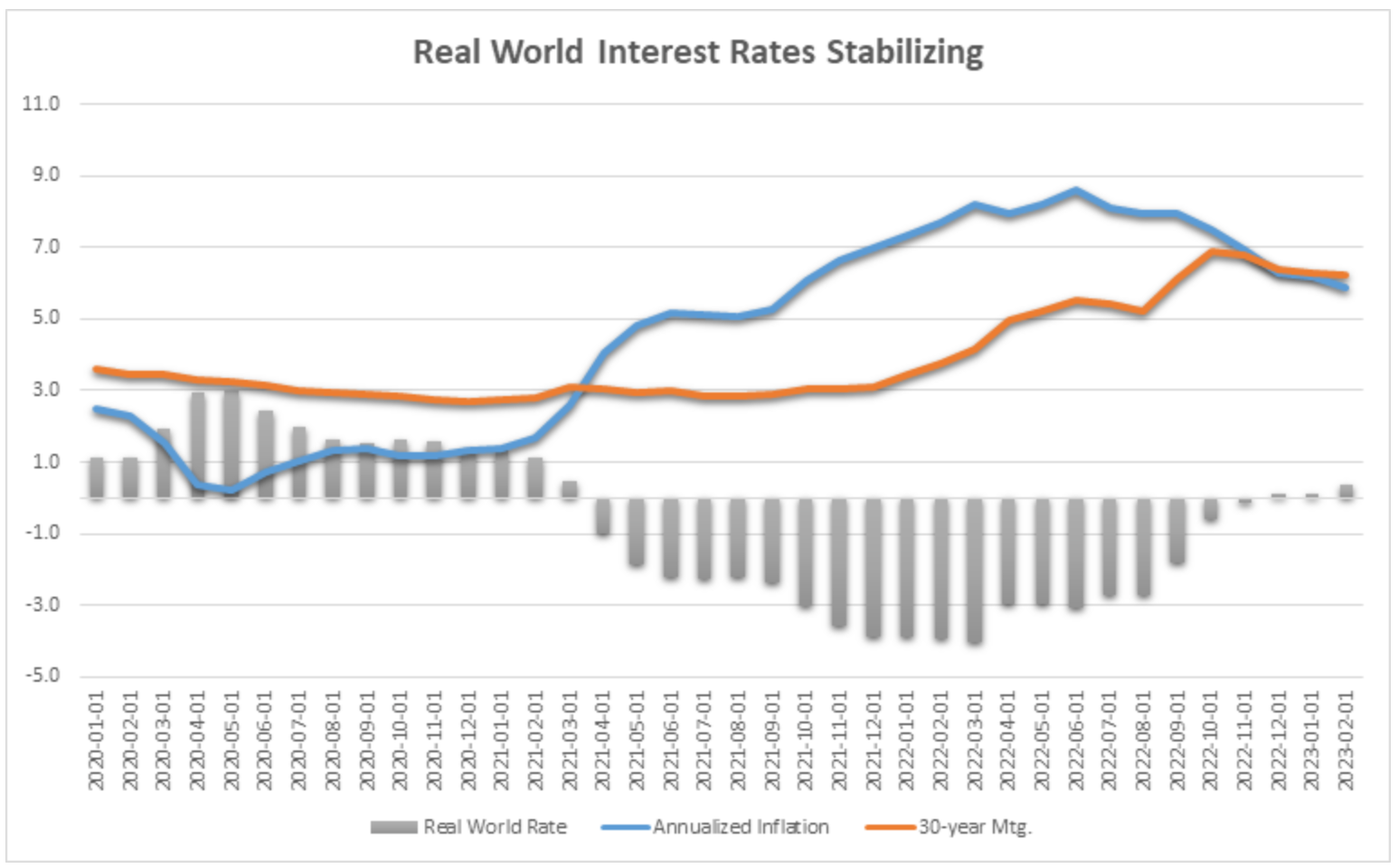

On the all-important subject of interest rates, inflation continues its steady (but slow) decline, and the last several months give reason to believe we are largely past rate increases.

Below we see the annualized rate of inflation, average 30-year mortgage rate, and the real world rate taken by subtracting the yield on the 30-year mortgage from inflation. For nineteen months real world rates remained negative, that is the return on a 30-year mortgage was less than the rate of annualized inflation. As inflation fell and rates rose, real world rates turned positive in December and continue to improve. This is a welcome indication that interest rates are stabilizing and will fall along with inflation as we progress through the year.

Bottom line:

- The influence of low interest rates on sellers continues to impact supply

- Buyer demand remains strong – absorption is in the 95-100% range and DoM is falling

- Properties now sell on average for 100% of asking price

- Without additional shocks to the system (i.e. bank failures, etc.), interest rates appear to have stabilized and there is a solid basis for expecting them to fall in the coming months

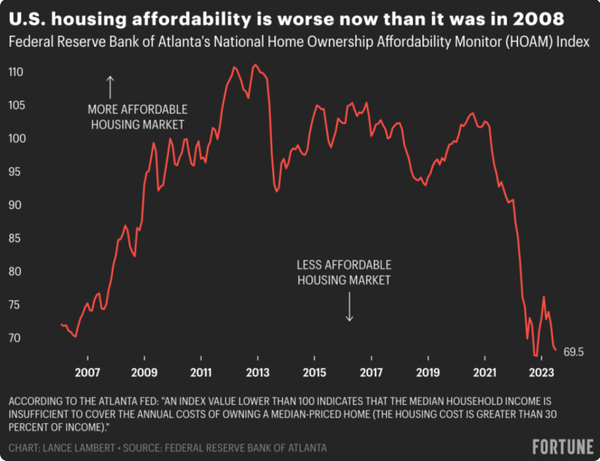

- Housing is not going to become more affordable in the near future, as prices are reacting quickly to lack of supply and abating rates

Stable pricing and low velocity – we have an interesting year ahead.

Recent Posts

GET MORE INFORMATION